Sweden for a toxic-free everyday environment. Tax on consumer products containing hazardous substances

Text extracted from the english summary (page 13) of the

Kemi Report 7/13 "How could a chemical tax on consumer products look like?" ("Hur kan en kemikalieskatt

på konsumentvaror se ut?")

*****

The Swedish Chemicals Agency has been assigned by the Swedish Government

to carry out an action plan for a toxic-free everyday environment.

The action plan includes the objective

of instruments other than chemical rules and product rules to be used

to a greater extent as a

supplement to reduce the risks of hazardous substances in products.

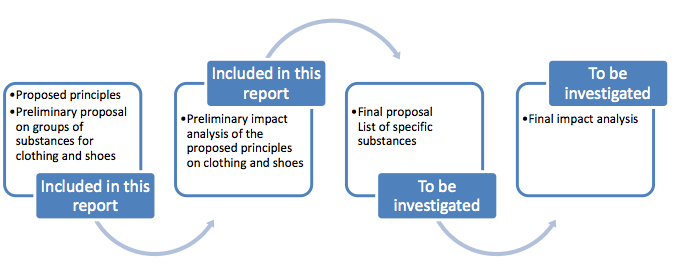

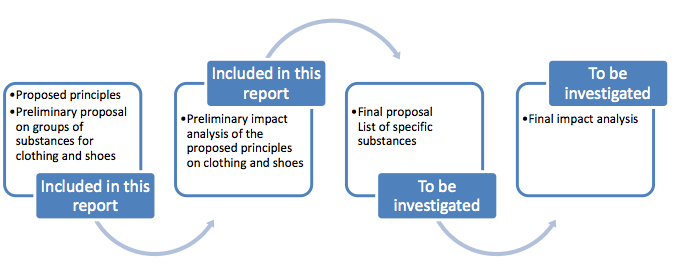

This report presents proposals on principles for excise duties that could be

the basis for a

chemical tax on consumer products containing hazardous substances.

The report also

describes how such a tax could be designed for the product group clothing

and shoes, and

includes a preliminary impact assessment of such excise duty.

However, this is not a complete

proposal but if such a tax on clothes and shoes are to be implemented,

further investigations

are required, including the specific substances to be taxed.

Hazardous substances in consumer products depend on market failures,

for instance lack of

perfect information. Consumers have little opportunity to determine

which products contain

hazardous substances, leading to unconscious exposure to health risks.

Since the chemicals policy largely comprises harmonized EU rules,

Sweden has on its own limited opportunities to prohibit the presence

of hazardous substances in consumer products.

However, Sweden has control over which environmental taxes we choose to impose. National

environmental taxes will enable Sweden to push for substitution and innovation in the

chemical field, which can stimulate restrictions on more substances at EU level.

The Swedish Chemicals Agency estimates that the following principles are appropriate for an

excise duty on hazardous substances in consumer products:

|

- 1) The chemical tax is governed by its own excise duty act. This act would offer a common

framework for chemical taxes on various consumer product groups.

- 2) The scope will gradually be extended to more consumer product areas and more hazardous

substances.

- 3) The consumer products containing substances from a "list of hazardous substances that

meet the criteria for taxation," from now on called hazardous taxation substances, become

taxable. Different lists are drawn up for each product group.

- 4) The hazardous taxation substances are known to occur in the product group in question.

- 5) The hazardous taxation substances shall not already be banned or restricted for the use in

question.

- 6) The hazardous taxation substances have properties that are hazardous to health or the

environment under EU law, international conventions, or may pose a risk of significant

exposure to humans or the environment.

- 7) The existence of any hazardous taxation substances shall be measurable in the product

groups in question with a standardized or established method of analysis. A lower

concentration limit for each hazardous taxation substance shall be available. Products

containing a lower concentration than the lower concentration limit shall not be taxable.

- 8) Those obliged to pay a tax shall be both those that import from third countries, import from

the EU or manufacture consumer products to place on the Swedish market.

- 9) Tax levels should be set high enough to have a controlling effect.

- 10) Retailers of consumer products should not be required to inform consumers that they have

paid taxes for the product in connection with the purchase.

- 11) The tax levied should be per kilogram or be based on amounts of hazardous taxation

substance. What is appropriate should be investigated further.

- 12) Those who are unsure about what the product contains may, instead of requesting

information from the supplier or making a chemical analysis of the product, choose to pay a

flat tax for the product.

- 13) The tax shall otherwise be administered according to the same principles as other excise

taxes in Sweden.

|

The Swedish Chemicals Agency tentatively suggests that hazardous substances

tax for

clothing and shoes be derived from the following groups of substances: phthalates, allergenic

or carcinogenic dyestuffs and antibacterial substances.

Selected substances should not be

prohibited in clothes and shoes and there should be appropriate methods to measure the

substances. Which individual substances to be included on the list of hazardous taxation

substances needs to be investigated separately.

Both the proposal for a chemical tax on several consumer product groups and the proposal for

an excise duty on clothing and shoes that contain hazardous substances are deemed to be

compatible with both the EU's equal treatment principle and state aid rules.

A complete

proposal must be notified to the European Commission before it is implemented.

The

European Commission generally looks favorably on environmental taxes and no national

environmental tax has so far been considered by the Court.

Responses from industry representatives and companies show a positive attitude to the

chemical tax leading to more similar obligations on all businesses. Today, it is up to the

various clothing and shoe companies to choose their level of ambition.

That is perceived as

unfair by those companies that have invested in good control over what

their products

contain. Meanwhile, representatives from industry and companies are

concerned about how

companies should manage to identify all items of clothing containing

hazardous substances

since supply chains are often long and difficult to monitor.

Companies are also concerned that

Sweden will set specific requirements that are not imposed on companies

in other countries

and that the foreign-based e-commerce will increase.

However, companies are already now responsible for ensuring that the products they put on

the market are safe for humans and the environment. To take this responsibility in full,

companies need to develop their quality and inspection work in supply chains. This problem

persists with or without a tax. E-commerce is expected to increase with or without a chemical

tax.

The Swedish Chemicals Agency estimates that a chemical tax on consumer products can help

to achieve the Swedish environmental objectives in the chemicals area. A chemical tax does

not stand in opposition to a future EU restriction but may, on the contrary, facilitate the

introduction of such a tax by driving forward innovation and substitution. We consider that of

the examined alternative instruments, i.e. chemical tax, dialogue, EU restriction, increased

focus on environmental labelling and information campaign for consumers, a chemical tax

would be the alternative that gives the highest overall gain for society.

*****

- Text and pictures extracted from the following internet document:

Kemi Report PM 7/13